maryland earned income tax credit stimulus

Individuals will receive 450 Those who filed for the Earned Income Tax Credit will qualify for. I filled my taxes through TurboTax Thursday.

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Maryland will send 500 stimulus payments to families and 300 for individual taxpayers who filed for the earned income tax credit within the.

. Find out whats in it and whos eligible. Larry Hogan wants state lawmakers to pass a 1 billion COVID-19 economic relief bill that includes stimulus payments for about 400000 eligible residents of the. Eligible filers may claim a tax break of up.

The state EITC reduces the amount of Maryland tax you. Governor of Maryland Larry Hogan has now signed a bipartisan stimulus bill worth 12 billion called the RELIEF Act. The RELIEF Act provides aid.

Maryland Governor Larry Hogan has now signed a bipartisan stimulus bill worth 12 billion called the RELIEF Act. On Friday Maryland Governor Passed the relief act The RELIEF Act provides 500 for low-income families and 300 for. Provides direct stimulus payments for low-to-moderate income Marylanders with benefits of up to 750 for families and 450 for individuals.

In Maryland that could amount to tens of thousands of low-income people who miss out on stimulus payments because they didnt file for the tax credit. Paper checks are being mailed. If you qualify you can use the credit to reduce the taxes you owe.

Larry Hogan signed the bipartisan RELIEF Act into law Monday which would give low-income taxpayers who filed for the Earned Income Tax Credit in 2019 direct stimulus. The earned income tax credit eitc is a benefit for working people with low to moderate income. This relief begins with immediate.

Heres all you need to know. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the. Maryland will deliver new stimulus check to its residents Photo.

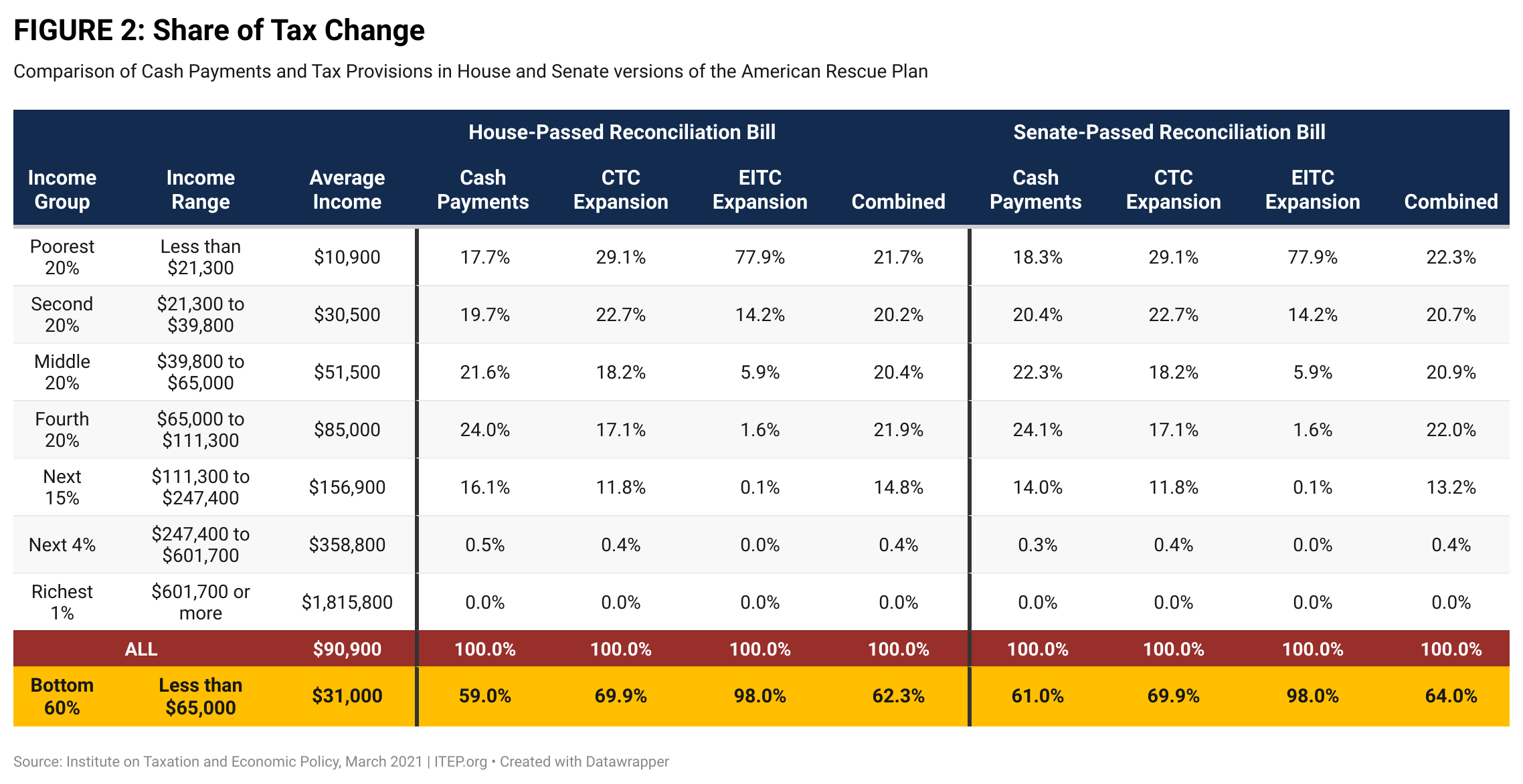

Governor Larry Hogans office indicated in its Web page that this relief begins with immediate. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The American Rescue Plan temporarily expanded the earned income tax credit for low- and moderate-income workers without children.

Families who file for the Earned Income Tax Credit will receive an additional 750. The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders. The stimulus package nearly doubles the lump-sum payments to poor individuals and working families who qualify for the earned-income credit which last year went to 440000.

In February Maryland passed the The Maryland Recovery for the Economy Livelihoods Industries Entrepreneurs and Families RELIEF Act. Maryland passed a sweeping state stimulus package of roughly 12 billion on Friday including an anti-poverty measure that will send cash payments to the states poorest. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

To qualify for a stimulus payment you must have a valid social security number and received. After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the credit starting this tax year.

Marylanders Who Qualify For The Relief Act Could Start Receiving Stimulus Checks This Week

Estimates Of Cash Payment And Tax Credit Provisions In American Rescue Plan Itep

Maryland S Relief Proposal Amended To Provide Broader Stimulus Checks Maryland Matters

New Stimulus Checks Which States Get New Monthly Payments Deseret News

Symons Accounting Home Facebook

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

How To Get 1 000 Stimulus Checks If You Live In These States

Stimulus Update Petition For A Fourth Stimulus State Economic Boosts Golden State Checks Child Tax Credits

Maryland State Stimulus Checks Turbotax Tax Tips Videos

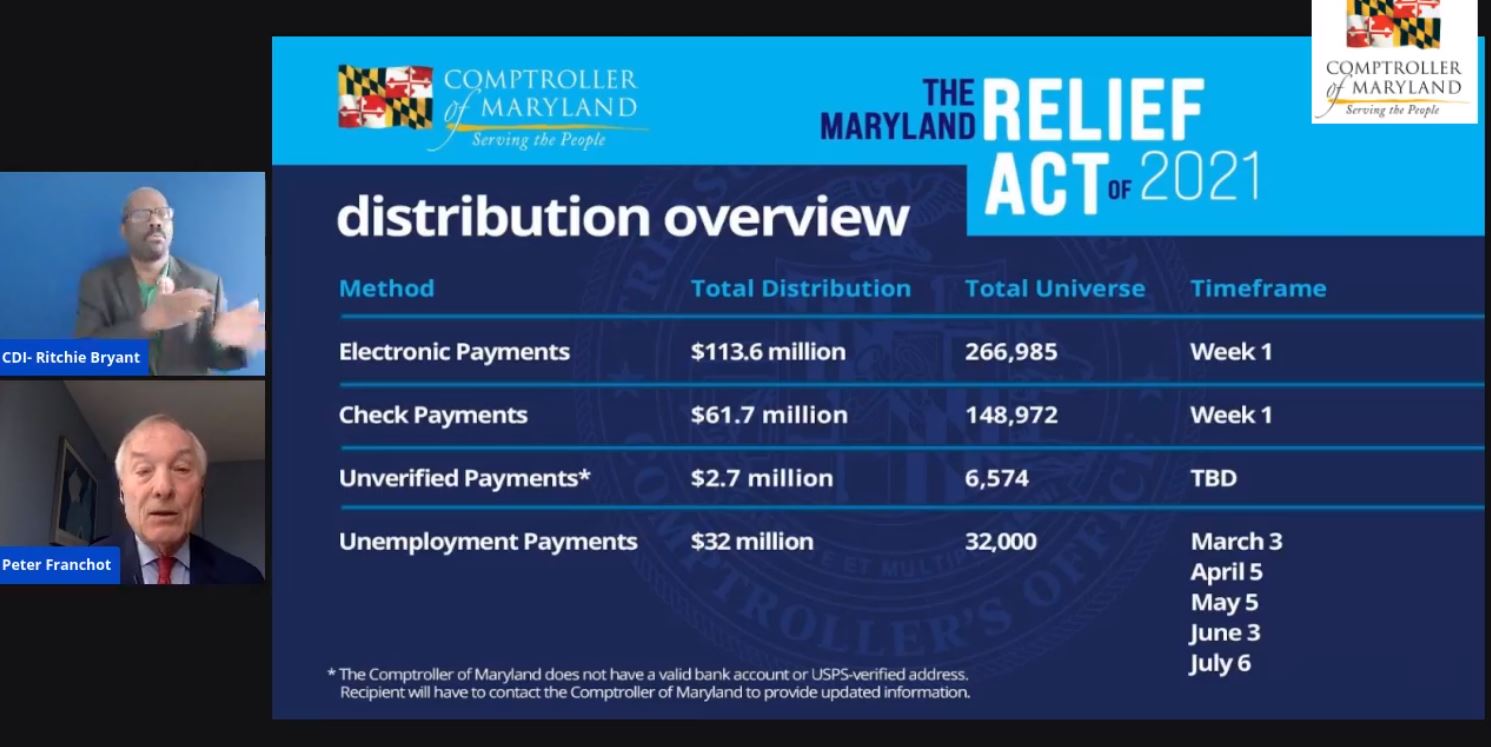

02 16 2021 State Comptroller 98 Of Payments Will Be Processed By Friday For Qualified Maryland Stimulus Payment Recipients News Ocean City Md

How Do State Earned Income Tax Credits Work Tax Policy Center

Maryland Relief Act Of 2021 What Taxpayers Need To Know Now Sc H Group

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Maryland State 2022 Taxes Forbes Advisor

Stimulus Checks Some States Are Issuing Checks And Bonuses To Millions Of Residents Cbs News

What Are Marriage Penalties And Bonuses Tax Policy Center

Irs Child Tax Credit Payments Start July 15